Credit Union Chooses HubSpot to Improve Email Marketing Efforts to New & Existing Members

INTRODUCTION Montana credit union offers the conveniences of a big bank locally.

Whitefish Credit Union has been serving Montana customers since 1934 and has become the largest credit union in the state. They came to Instrumental Group with a fresh perspective on digital communication to enhance campaigns to drive more business from personal and vehicle loans, home equity lines of credit, mortgages, checking accounts, debit cards, and a variety of savings plans.

PROJECT OVERVIEW

PRIORITIES Data-driven campaigns powered by HubSpot.

HubSpot was a platform they saw as necessary to support their goals through deep automation capabilities. Whitefish Credit Union needed a partner who would understand how to bridge current campaigns with HubSpot capabilities. Instrumental Group became that partner, and a twelve-month engagement commenced.

SOLUTION Email automation through HubSpot and integrated data.

With digital campaigns in place to drive new and expanded business for Whitefish Credit Union, we got to work in helping automate email communication through HubSpot.

Step 1: Discovery & Audits

Remaining a trusted local full-service financial institution, such as Whitefish Credit Union, while automating communications required a deep understanding of the nuances of locations, channel and demand strategies, and orchestrating communications with customers.

Our goal through discovery was to understand current marketing strategies and plans to form the strategy of the future.

- Goals & KPIs: Aligning SMART goals early is critical to success. We leveraged our goal-setting framework and a series of discussions to form benchmarks and projections. Our goal targeted email performance and included the KPIs important to Whitefish Credit Union for performance reporting.

- Marketing Automation Audit: We audited relevant digital marketing systems to understand the environment we'd be working within and migrating from. We dug deep, uncovered issues, made observations, and shared ideas for quick wins and long-term success.

Step 2: HubSpot Architecture & Configuration

After gaining a strong grasp on Whitefish Credit Union's current MarTech and digital marketing strategies, we began to build foundational elements of the email strategy that expanded upon:

- HubSpot Marketing Configuration: Instrumental Group helped get Marketing Hub Enterprise configured and trained the team in an accelerated time frame to help drive value from the platform early.

- Postalytics' Onboarding: We completed the initial setup and integration with HubSpot to ensure Postalytics was ready to assist campaign efforts.

- Asset Creation: We built full-funnel conversion paths, emails, and landing pages powered by HubSpot functionality to serve future campaigns.

This is where we set the plan for a robust implementation that meets all of the organization's requirements. We took the learnings and user stories developed during discovery and applied them to Architecture Map.

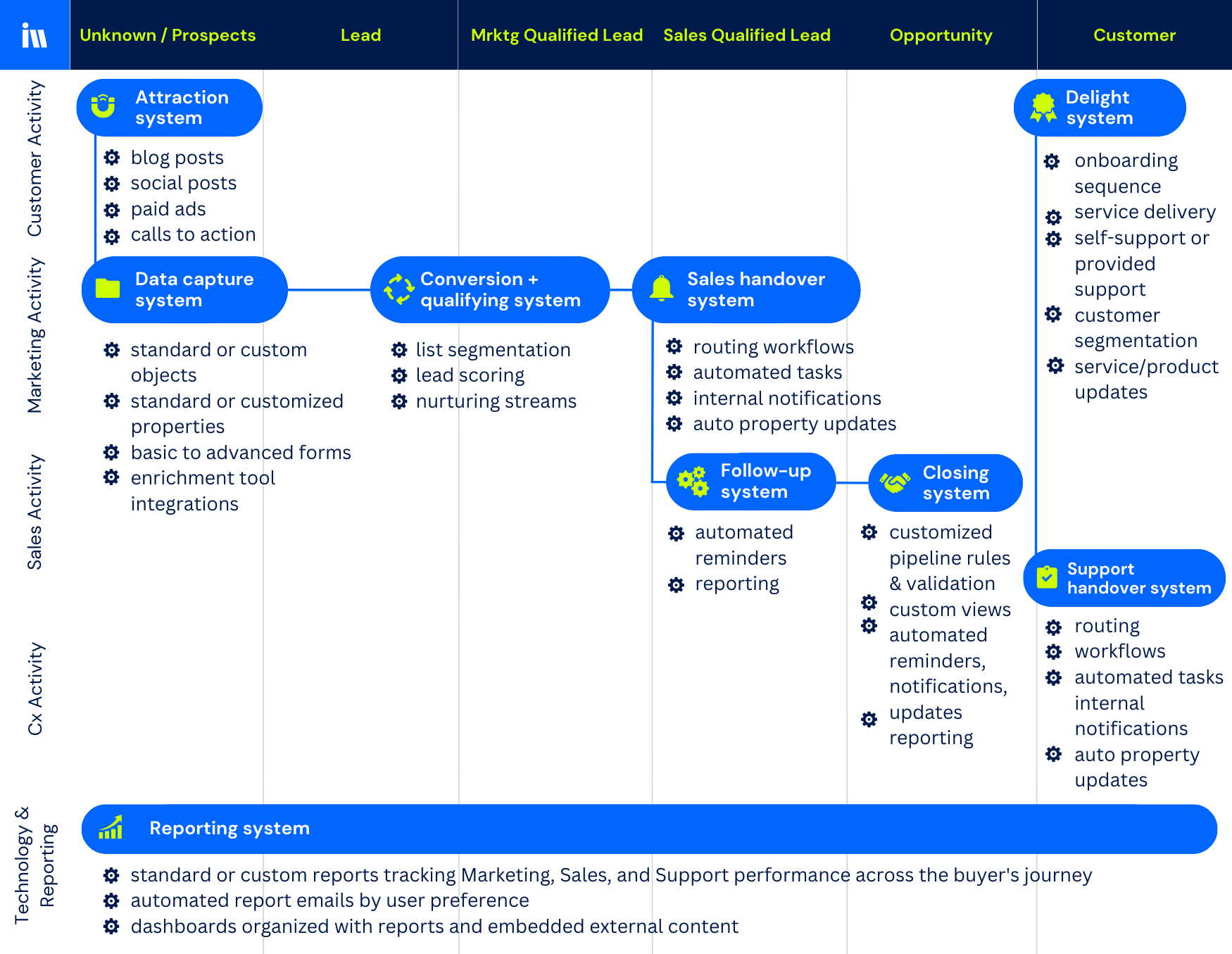

The Architecture Map allows us to visualize how customers, internal team members, technology, and data all flow and operate within a single system. This visual diagram will enable us to ensure all processes can be fulfilled while helping our clients understand the inner workings of HubSpot in support of their goals.

The Architecture Map is built into swim lanes, organizing activities and triggers along the customer journey.

- How prospects experience the lending, account, and new customer experience.

- Business development activity along the way

- CRM activity, including attribution, qualification parameters, automation, workflows, and reporting criteria

- All technology leveraged throughout the journey

- Lifecycle progression throughout automation triggers

The image below is an example of an Architecture Map, simplified and representative only. [click to open enlarged version]

Step 3: Data Migration & Integration

CRM Data Migration

Our team was responsible for effectively migrating all records and history from Core to HubSpot. While the first step was technically completed during discovery, here's how the process looked for each CRM:

- Step 1: Migration Audit & Field Mapping: Building upon the initial strategy and discovery, we diligently engaged in the technical process of mapping essential data fields across various record types within Core.

- Step 2: Field Configuration: Each field critical to communications was meticulously crafted and arranged to guarantee that every piece of data found its perfect home within the HubSpot CRM.

- Step 3: Data Migration: We revised the data exports from Core, aligning headings and naming conventions to ensure a seamless import into HubSpot. Thanks to HubSpot's user-friendly CRM import features, the process became effortless after the formatting was synchronized.

- Step 4: Validation and Testing: We conducted a joint review of the migrated data to guarantee its accuracy. After some minor adjustments, the data has was effectively imported to HubSpot, accurately populating the appropriate fields.

Integration with Core

Initially, we imported critical data from Core to HubSpot via the HubSpot import tool to power the new customer onboarding campaign; however, we knew this wasn't a long-term, scalable solution for executing email communications through automation. So, we partnered with the Whitefish Credit Union team in integrating Core data with HubSpot, following similar steps as we did with the initial data migration; however, with this being an ongoing two-way integration, we ensured that we had a continuity plan for ongoing testing and support of the integration.